Don’t Expect the AI Cost of Entry to Drop Anytime Soon

As we begin 2025 in earnest, the biggest stumbling blocks for AI adoption seem to be fear of risk, lack of a safe environment for testing AI services, and waiting for policies and guidelines to provide support for moving forward. So, while financial institutions continue to congregate at the AI starting line, other barriers lie just ahead; chief among them will be cost.

AI costs can be assessed per person (“per seat”), by application or as an add-on, as Microsoft charges for Copilot. AI can be expensive. At $20 per seat per month, if everyone is given a license, a bank with 2,000 employees can expect to pay $480,000 per year. At $30 per user per month, that jumps to $720,000 annually.

To complicate matters, no single AI vendor does it all. Many employees will need subscriptions to multiple AI services, similar to what consumers face when choosing entertainment streaming services.

Of course, one can argue that not every employee needs AI access. Different staff roles may need different licenses. But even with AI provisioning, costs will be going up, not down — much like Uber, which eventually stopped offering low entry pricing to gain attention and market share.

DISCOVER: Microsoft Copilot helps workers automate mundane tasks.

Profits Aren’t a Priority for AI Companies, Yet

Companies that exclusively provide AI services have enormous overhead and operating costs. These include software development, AI system learning, knowledge and information compilation and digestion, and computer hardware use, which entails unprecedented energy consumption. The entry-level teaser rates offered today are simply not sustainable.

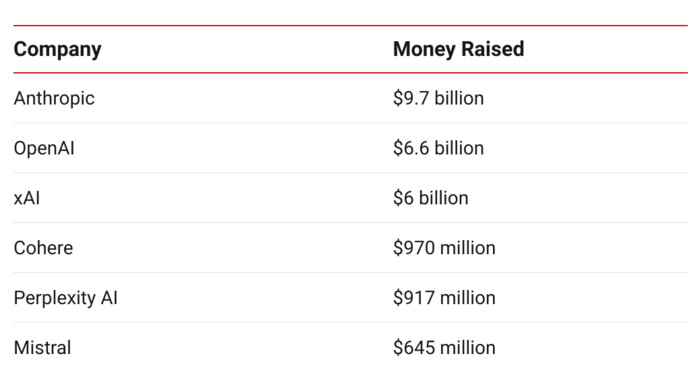

This chart shows just some of the leading AI companies in terms of money raised through the end of 2024.