Mastering IT Compliance Requires a Balancing Act [#Infographic]

While compliance audits aren't pleasant, they do ensure standards and a minimum level of security across industries. But getting an organization's IT up to compliance standards can require significant investments and resources that might prove challenging to fulfill.

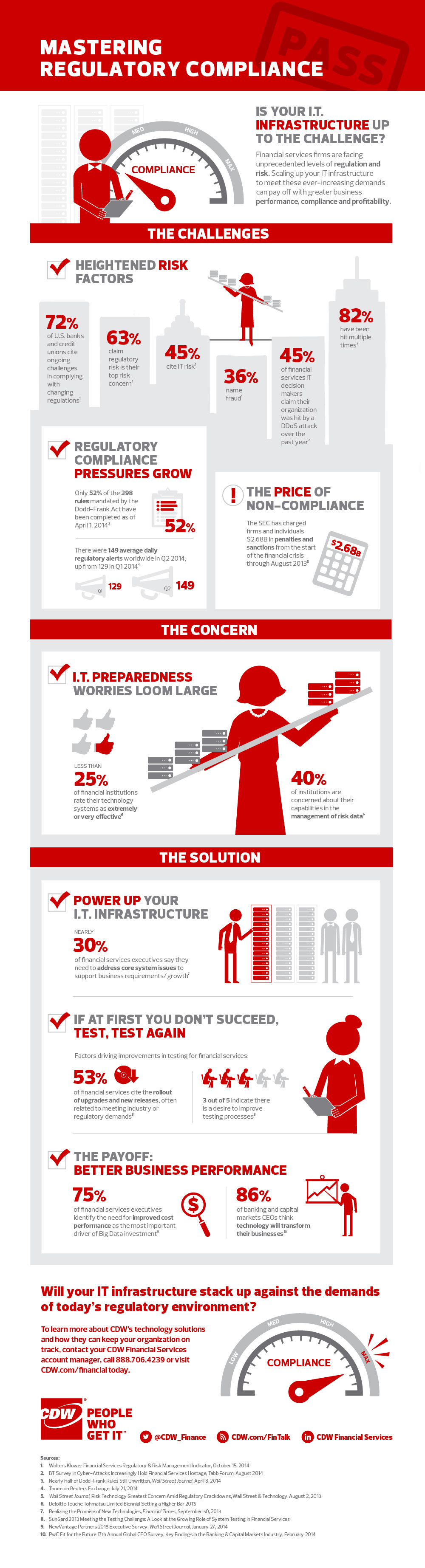

As if adhering to a compliance standard wasn't challenging enough, these standards, such as Dodd-Frank, often continue to evolve and change as legislation continues to shape and reform it. That's why 72 percent of U.S. banks and credit unions "cite ongoing challenges in complying with changing regulation," according to an infographic from CDW's FinTalk blog. But avoiding compliance isn't an option, as the SEC has charged $2.68 billion in fines and penalties to companies and individuals since the start of the financial crisis through August 2013, FinTalk reports.

To learn more about mastering compliance, check out the full infographic from FinTalk below.