Credit: Photo courtesy of Ally Financial

How Ally Financial Guards Against AI Data Breaches

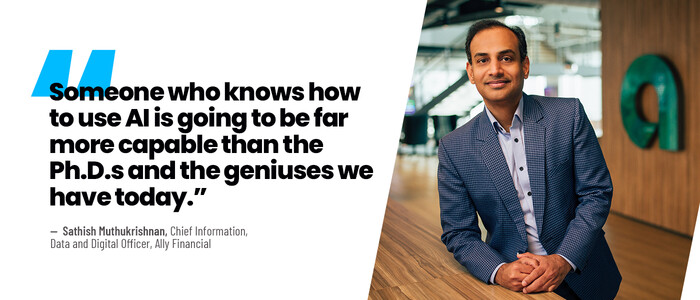

Creating customer service call summaries is one of several ways Ally is using AI to make life easier on its teams through process automation. Ally’s marketing team uses it to generate short summaries of financial education articles, and the internal auditing team uses AI to plan and scope audits. In fact, Muthukrishnan says, by using AI, the auditing team has shrunk some process timelines from days down to hours.

In all cases, though, Ally follows three key principles to make sure its AI efforts are safe and accurate. First, the company is focusing on internal-facing use cases until the technology evolves. Second, all AI workflows continue to keep a human in the loop, ensuring that AI tools aren’t making decisions without any oversight. And perhaps most critically, Ally never sends any personally identifiable information to external large language models.

The call summarization tool transcribes customer calls into text, organizes the content appropriately and sends it to AI for summarization before returning the results. Critically, the tool strips conversations of all PII before they are processed by AI and then “rehydrates” this information within the call summaries.

Muthukrishnan notes that Ally is the first U.S. bank to become a member of the Responsible AI Institute. “We’re interested in adopting and using it responsibly,” he says. “We take this extremely seriously. We think first about risk and security, and then we think about the magic of the technology.”

Mastercard Uses AI To Reduce Fraud

AI is nothing new for Mastercard, which has been using the technology for more than two decades for network security and intelligence. But recent advancements have sparked new AI-driven tools that identify fraud, improve decision-making and assist cardholders and merchants.

“We integrate off-the-shelf technologies such as scalable cloud infrastructure and data processing components, in addition to AI and machine learning capabilities, to ensure that our solutions are robust, scalable and capable of meeting the evolving needs of the market,” says Rahul Deshpande, executive vice president and global head of research and development.

The company’s Decision Intelligence solution leverages AI, along with billions of data points, to generate risk scores for transactions. Its Safety Net tool uses AI to monitor all transactions across the Mastercard network, identify widespread fraud attacks and mitigate them. And Shopping Muse combines personalization with generative AI to help shoppers more efficiently find products in retailers’ digital catalogs.