The Many Ways Financial Institutions Apply Analytics

Financial services institutions turn to advanced data analytics solutions to help them protect their customers against fraud, make smart investments and or evaluate loan applications, among many other use cases.

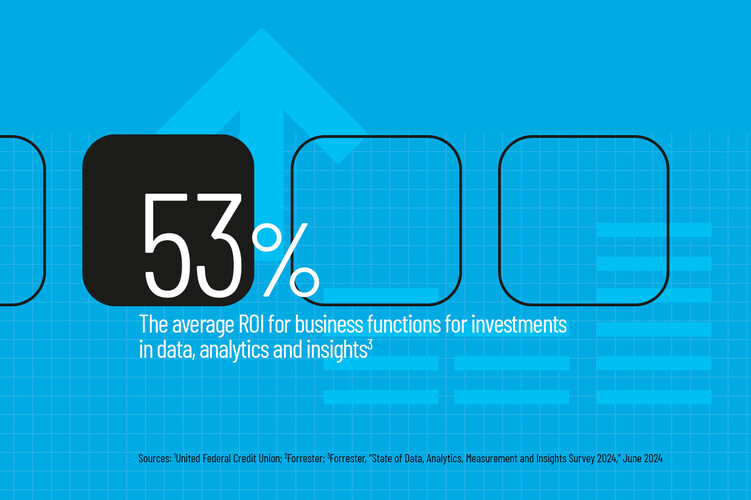

Platforms such as Google Cloud, Qlik and Tableau make sense of massive data sets and gain real-time insights into customer behavior, risk and operational performance, according to Indranil Bandyopadhyay, principal analyst at Forrester.

“These platforms allow institutions to create interactive dashboards, automate reporting and integrate structured and unstructured data for deeper analysis and faster, more accurate business decisions,” he says.

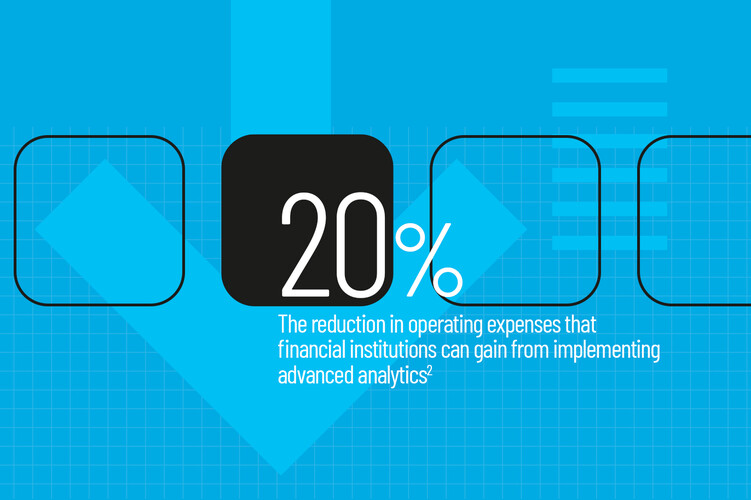

Advanced data analytics drive decision-making for financial institutions on credit approvals, policy underwriting, fraud detection and investment strategies, as well as payroll and resource allocation on the operations side, Bandyopadhyay explains. He adds that analytics-driven decisions can help institutions optimize lending, manage risk, streamline claims and boost efficiency.

RELATED: The financial solutions and services from CDW that can help your team.

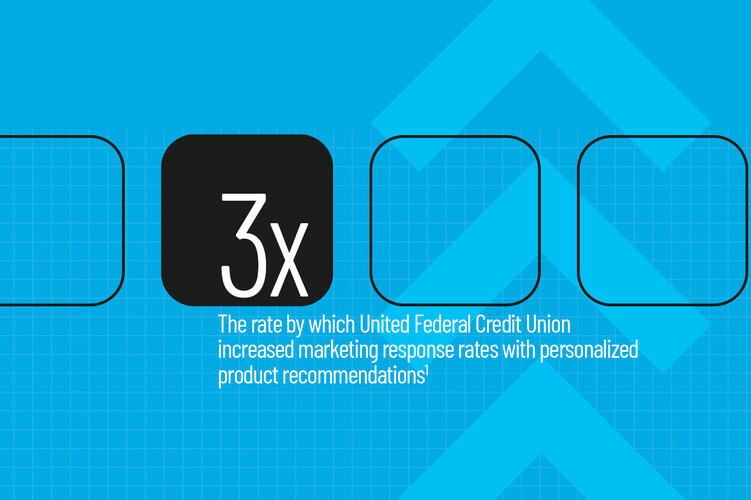

For United, a key feature is the membership overview dashboard, which provides more than 170 ways to filter members to create targeted lists. United can pull data from the dashboards and export it directly into its customer relationship management application after the digital marketing team examines it.

“My team focuses on getting that data out there into a format that’s easy to use, and then upskilling the business units on how to use those dashboards,” Benassi says.

The filters in Qlik allow United to track customer growth rates, see who may be at risk of soon canceling a membership, who should receive checking account promotions and more.

“Being able to see all of that in one place really allows you to dive deeper into answering your questions,” Benassi says.