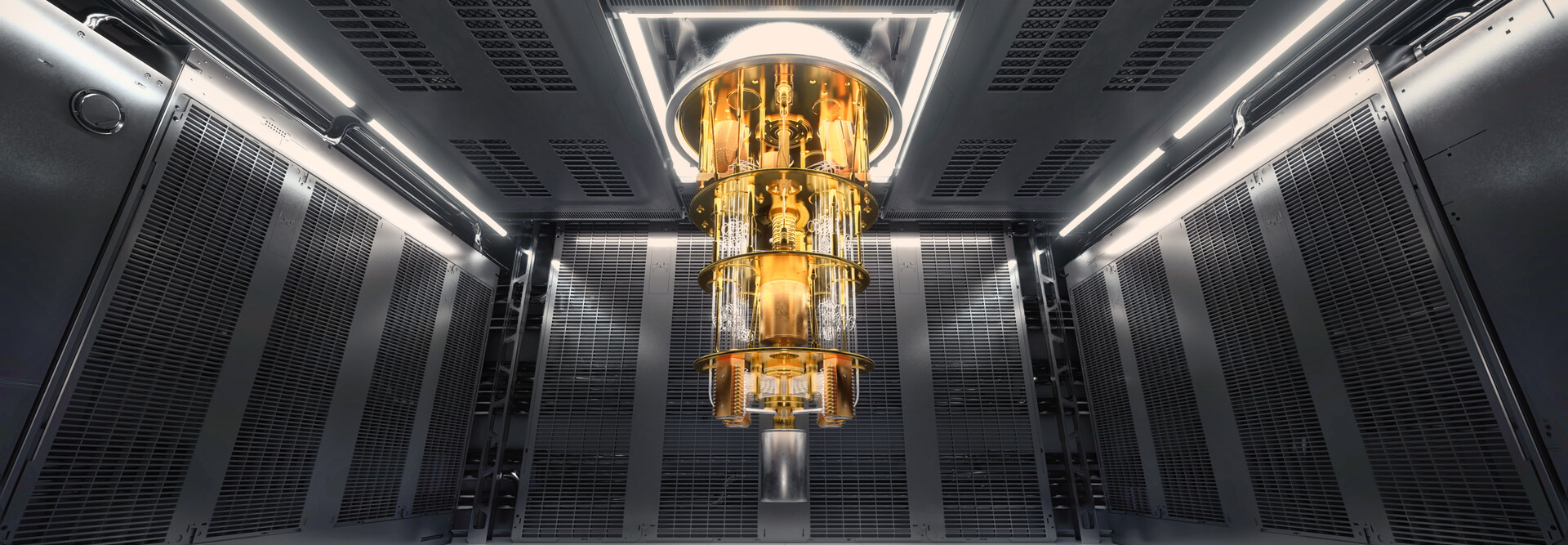

Here are four ways quantum computing can improve the financial industry:

1. Quantum Computing Will Reduce Credit Risk

Credit lenders strive to accurately determine the level of risk they’re taking on when extending credit to a borrower. By analyzing multiple factors such as the borrower’s income, credit utilization ratio and payment history, they can estimate the probability that the borrower will pay back a loan, as well as the potential loss they may incur from nonpayment.

Traditionally, lenders used Monte Carlo simulations to estimate the probability of loss from nonpayment. However, due to the large volume of financial data samples that must be processed to produce an accurate estimate, these simulations are often computationally intensive and sometimes lead to misleading or inaccurate results. Quantum computers solve this problem by replacing Monte Carlo simulations with quantum amplitude estimation, an algorithm that can produce precise estimations using fewer data samples. This not only reduces the time and resources required to process loan estimations, but it’s scalable enough to integrate more data samples into the estimation without overburdening the system. This could ultimately yield more accurate results.

2. Quantum Computing Maximizes Portfolio Optimization

The use of machine learning algorithms has quickly grown in portfolio customization as portfolio managers look for better ways to allocate their clients’ investments to generate the highest possible returns.

Much of today’s portfolio optimization strategies are based on modern portfolio theory, which encourages investors to assemble a portfolio that maximizes expected returns for a given level of risk. Machine learning addresses several critical nonfinancial factors that modern portfolio theory cannot, such as environmental, social and governance (ESG) ratings and investor behavior. In the real world, these factors contribute to price volatility and the probability that a controversial decision would negatively affect a company’s stock performance. Machine learning allows portfolio managers to take a whole-of-data approach when customizing a portfolio.

Integrating quantum computers into the mix will boost the algorithms’ performance by thinking faster and reconciling complicated data patterns more efficiently. This quantum machine learning capability also has the capacity to learn from smaller data sets and reveal correlations portfolio managers could leverage to apply the right balance of assets in a portfolio, with greater speed and accuracy.

3. Quantum Cryptography Will Boost Data Security

Financial institutions manage large amounts of capital and customer data, which makes them prime targets for cybercriminals. According to Statista, financial institutions worldwide reported 3,348 cybersecurity incidents in 2023, an astounding 58% rise from the year prior. Unfortunately, the fight against cyber incidents will only intensify once quantum computers are fully realized and cybercriminals begin using them to threaten financial institutions.

The solution, however, might be found in quantum cryptography. QC harnesses the fundamental laws of quantum mechanics to defend against quantum computer–enabled cyberattacks. QC encryption protocols such as quantum key distribution and quantum coin flipping were designed to establish the type of unconditionally secure communications that classical cryptography protocols could not. With QC, financial institutions can rest easy knowing their records, communications, transactions and customer data are safe from quantum exploitation.

Though QC is still in its early stages, some financial institutions are conducting real-world experiments with QC in hopes of one day incorporating it into daily operations.

Click the banner below for financial expertise on navigating regulatory compliance.