How Credit Unions Can Compete with Fintechs

Within the financial services industry’s fierce competitive landscape, credit unions have long played the part of the scrappy, nonprofit upstarts, leveraging their personal relationships with customers to compete with deeper-pocketed banks.

But now, credit unions and banks alike face an existential threat from fintechs, a whole new kind of online-only rival that offer customers a range of innovative products, from cheap mortgages to investment portfolios.

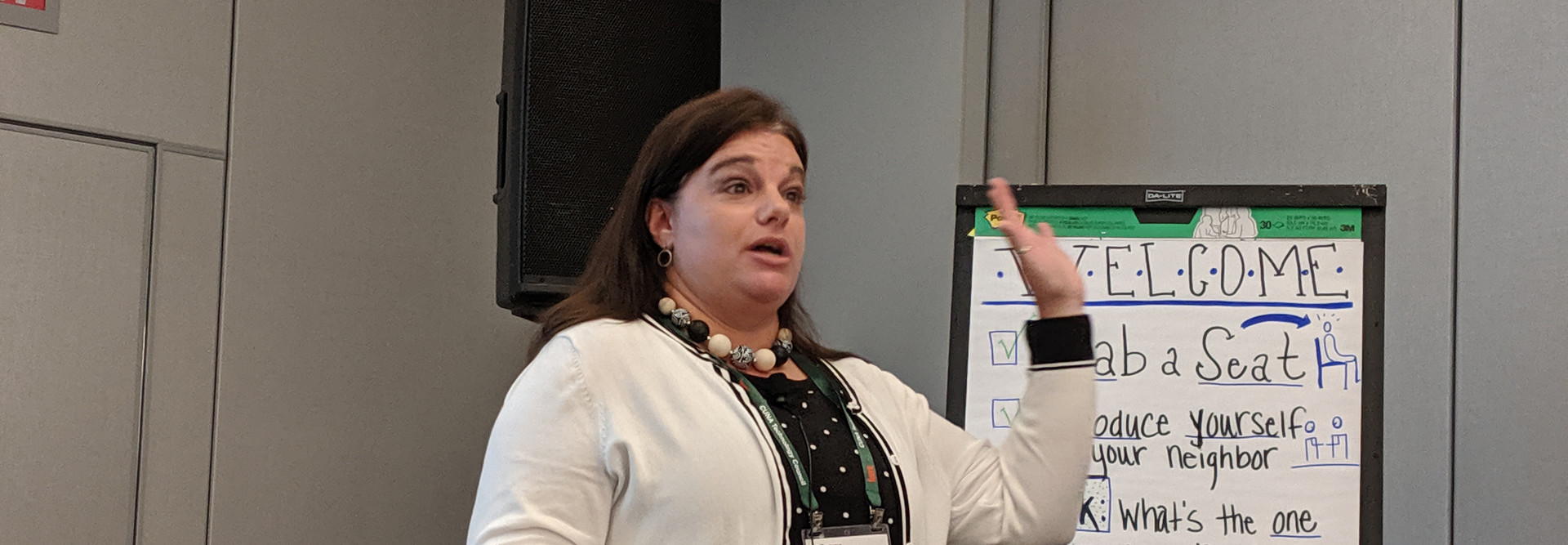

Whether they are able to survive this new threat depends mostly on how effective they are in rethinking their relationships with customers, argued Lauralee Hites of management consulting firm Stratavize. She said that credit unions may not have the reputation for member service that they think they do.

“It’s easy to say we’re leading in service, but are we really doing it?” said Hites, speaking at the annual meeting of the Credit Union National Association (CUNA) Technology Council in Chicago. “Are we measuring it? What I hear is, ‘We win at service.’ But that’s not what I see. It’s not what I see with mystery shoppers, it’s not what I see in surveys, it’s not what I see in the data.”

Competition from Fintechs Has Surprised Credit Unions and Banks

Credit unions and banks have been caught off guard by the speed at which fintechs have eaten into their businesses. Take mortgage lending, for example. “As recently as 2010, three banks (Wells Fargo, Bank of America and Chase) originated 56% of all mortgages,” notes MagnifyMoney. “But in 2017, Wells Fargo, Bank of America, Chase and all banks put together originated just 40% of all loans.”

Today, Quicken, which has no branches and offers no checking accounts or other banking services, is the nation’s second-leading mortgage originator, trailing only Wells Fargo. Hites, who once worked for Well Fargo, said the big bank didn’t take fintechs like Quicken seriously at first.

“They thought, ‘No one’s going do that. We’re the giants in the mortgage industry,’” Hites said. “Now the talk at the table is, ‘What are we not doing that Quicken is doing? It happens very quickly.’”

Credit unions are unlikely to build the next killer financial app. But by taking note of some of the elements of an effective fintech app, they can do a better job of building digital experiences their own members will value.

Fintechs Connect Emotionally with Customers

Fintech applications are built to connect customers emotionally with the things they want to do. Credit union apps and websites tend to be more utilitarian, Hites said.

One fintech application, for example, offers users the chance to save money in funds for special purposes, like vacations and buying a home; each fund is presented visually with someone enjoying a favorite activity. Likewise, every credit union offers members the same opportunity to open special purpose savings accounts, but they don’t make an effort to appeal visually or emotionally to their members, so those services are lightly used.

“My challenges to all of you is to put pressure on your web design vendors,” Hites said. “They have to make it look good. When you look at what they’re doing for some of the big companies and fintechs, it’s streamlined and beautiful, whereas ours tend to be clunky.”

MORE FROM BIZTECH: Check out how modern tech is making the branch of the future a reality today.

Fintechs Make Things Easy for Customers

Having taken over retail, will Amazon begin offering financial services next? Many conference attendees thought so, and Hites said credit unions would be wise to consider the online giant’s core competency.

“What Amazon does really well is they reduce customer friction,” she said. “They make things easy and fast.”

When it realized in its early days that customers were reluctant to purchase books without knowing what others thought, Amazon added reviews. When it realized that customers were annoyed with having to repeatedly enter credit card information, it developed its one-click checkout experience.

Amazon has already broken into several areas of the financial services business, like small business lending, and “checking accounts, small business credit cards and even mortgages all appear to be in the company’s sights,” reports American Banker.

Whether the company ends up competing directly with them or not, Hites argues that credit unions should emulate its approach to customer experience: “Have you noticed that Amazon is not always the cheapest option now? They’re not, but people still use them because they’ve reduced all the friction.”

Fintechs Focus on Helping Customers Improve Their Financial Health

Fintech applications are built to help people see clearly how their own actions are helping them improve their financial situations. The Acorns app, for example, lets people invest their spare change from purchases into the stock market. The app lets people see how their money is growing.

“Overwhelmingly, what we hear from customers is, ‘I want your help to grow financially and build wealth,’ and we respond with, ‘Here’s a money market account.’ And that’s not what they’re looking for,” Hites said. “So, these apps come along and show people how to save and grow incrementally. Our studies and surveys continue to tell us that people want help. Not necessarily more technology. It’s not the tech that’s going to beat us. It’s not. It comes down to the experience.”

The truth is that credit unions already have products that can help people grow financially, like those money market accounts. What they haven’t done is packaged those products in a way that helps people see how they’re doing and that encourages them to continue to act in their own interests.

“Tools that monitor or track one’s financial life are different from those that optimize or improve performance,” she said.

Follow along with our CUNA Tech Council Conference coverage on Twitter at @BizTechMagazine or the official conference Twitter account, #TECHCouncil.You can also check back here.

_0.jpg)