How Banks and Credit Unions Can Secure Their IT and Customer Data [#Infographic]

The last thing a bank or a credit union wants is to make headlines for losing or exposing customer data. At that point, not only would they suffer a reputational blow, but they would also be in legal and financial jeopardy because of federal regulations designed to help banks safeguard such information.

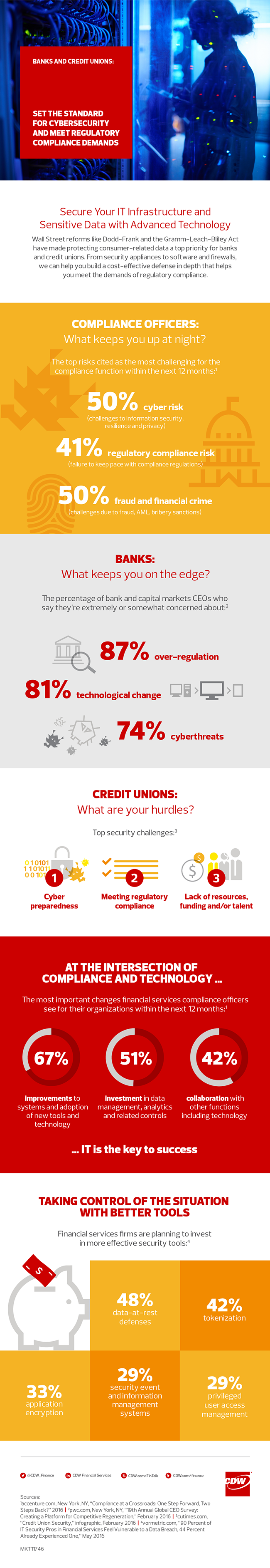

Compliance officers at banks and credit unions are concerned about information security and data privacy, and they strive to keep up with compliance regulations. Fraud and financial crime are also serious risks.

Further, compliance officers are focused on investing in new tools and technology as well as in data analytics and management.

How can financial institutions use technology to ensure they are maintaining compliance and keeping customer data safe? Solutions include data-at-rest defense, tokenization, application encryption, security event and information management systems, and privileged users access management.

Take a look at the infographic below to see how banks and credit unions can use technology to achieve regulatory compliance.

To learn how the right IT solutions and services can help financial firms navigate the compliance minefield, download this CDW white paper, How Technology Helps Banks and Credit Unions Meet Regulatory Mandates. For more on how federal regulations affect banks' compliance efforts, check out this CDW blog post. And to learn more about CDW’s security solutions, visit CDW.com/security.