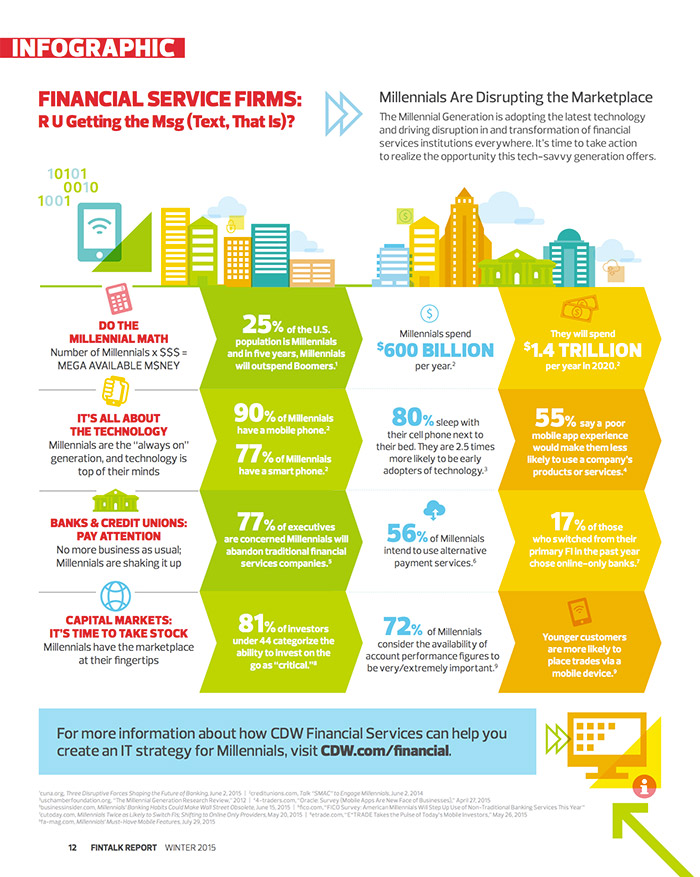

Millennials Are Disrupting the Marketplace

Millennials, who are two and a half times more prone to be early adopters of technology, are unlike any generation that’s come before them. And because their spending, banking and investing habits are heavily tied to their technology use, the traditionally slow-to-change financial services industry is in for a reboot.

According to information assembled for an infographic on CDW's FinTalk Blog, millennials have high expectations when it comes to enjoying on-demand access to financial information and services. Nearly 80 percent of millennials carry a smartphone, and more than half say they’d be likely to stop using a particular service or product after having a bad mobile app experience.

That statistic and others give weight to the concerns of executives, 77 percent of whom worry that millennials will at some point abandon traditional financial services companies. And considering millennials are projected to spend $1.4 trillion per year by 2020, financial institutions have a lot to lose if they can’t hold on to this tech-savvy generation.

For more information on how millennials are shaking up financial services, check out the full infographic from CDW below.