The Mainframe Strikes Back: IBM’s New z13 System Can Handle 2.5 Billion Transactions a Day

When people look back on retro technology and conjure up images of the computers of yesteryear, IBM’s gigantic mainframe computers from the 1950s come to mind.

These machines were massive in size and height and required specialized training to use.

But those mainframes are not the same mainframe IBM is pushing into the market now. The company unveiled its groundbreaking IBM z13 Mainframe computer today, and it’s purpose-built for our Big Data, mobile-first world.

The company claims that the z13 is “the first system able to process 2.5 billion transactions a day,” which it says is the “equivalent of 100 Cyber Mondays every day of the year.” Additionally, in an age where transactional data is more at risk than ever, IBM’s z13 Mainframe “is the first system to make practical real-time encryption of all mobile transactions at any scale.”

While consumers value the ease of mobile commerce, few know about or understand the complex backend infrastructure required to support those transactions.

“Every time a consumer makes a purchase or hits refresh on a smartphone, it can create a cascade of events on the back end of the computing environment. The z13 is designed to handle billions of transactions for the mobile economy. Only the IBM mainframe can put the power of the world's most secure datacenters in the palm of your hand,” said Tom Rosamilia, senior vice president, IBM Systems. “Consumers expect fast, easy and secure mobile transactions. The implication for business is the creation of a secure, high performance infrastructure with sophisticated analytics.”

That just goes to show that while the Mainframe hasn’t been seen as the most glamorous or cutting-edge piece of IT in some time, it can play an essential role in the modern IT landscape.

Rabobank, a Netherlands-based financial services institution, is one of IBM’s customers using the z13 mainframe technology, and Toine Straathof, executive vice president of Rabobank, credits the technology with powering its mobile services. “The mainframe is the backbone of our banking infrastructure, allowing customers to utilize mobile devices to access account balances, view transactions, transfer funds, pay bills, even find the nearest ATM or branch,” Straathof said. “With customer demands growing for an even more personalized banking experience, we will rely on the mainframe and IDAA to do even more to offer the right products based on a customer’s unique needs, and handling increasingly complex transactions with deeper analytic functionality.”

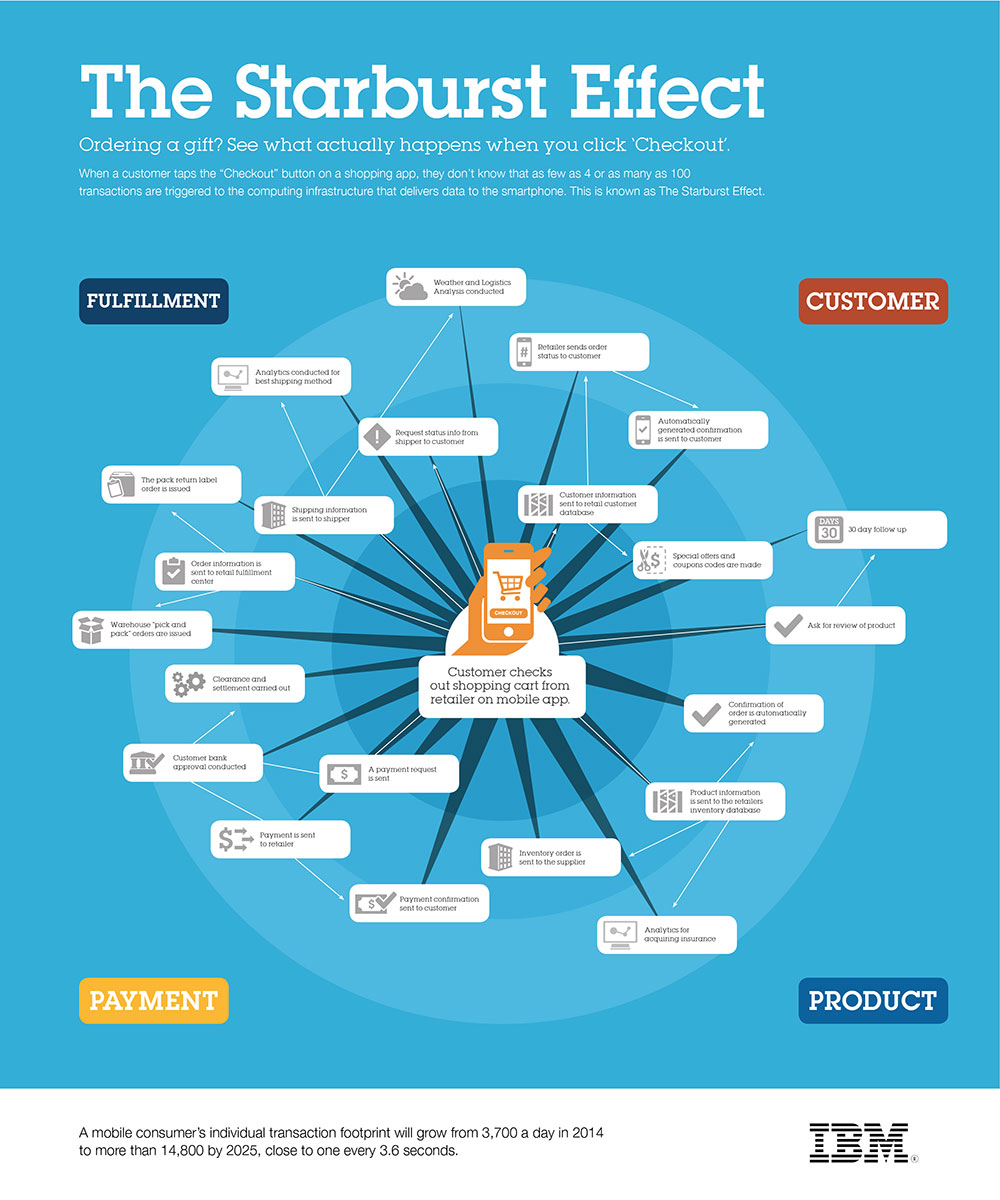

Securing the Starburst Effect

To explain the vulnerability that lies before retailers and financial services organizations, IBM uses an analogy that it calls the “starburst effect.” This essentially means that “a single transaction can trigger as few as four or as many as 100 additional system interactions.” Unfortunately, each of these interactions can create a security vulnerability.

Without a sophisticated, large-scale tool to track, analyze and neutralize these threats, many businesses are left wide open to attack. The z13’s real-time analytics capabilities allow organizations to stop fraud in its tracks before it affects the consumer, according to IBM. Further, the z13's analytics “can be used for fraud detection on 100 percent of a client's business transactions.”

Given the recent number of headline-grabbing hacks (Sony, Target and many more), it sounds like the IBM z13 Mainframe could be the Luke Skywalker to hackers’ Darth Vader. If you work for a retailer, bank, shipping company or supplier and have been worried about securing your corporate transactional data, now you know that the Mainframe can strike back — and is ready to.