Swipe Fees: A Secret Tax on Merchants [Infographic]

The ubiquity of credit cards and electronic payments have made most consumers so comfortable that many customers are foregoing cash completely.

In Europe, Sweden is on track to become one of the first cashless societies. Buses in some Swedish cities have stopped accepting cash, more businesses only accept electronic payments and some banks have ditched cash handling all together, according to a report from CBS News.

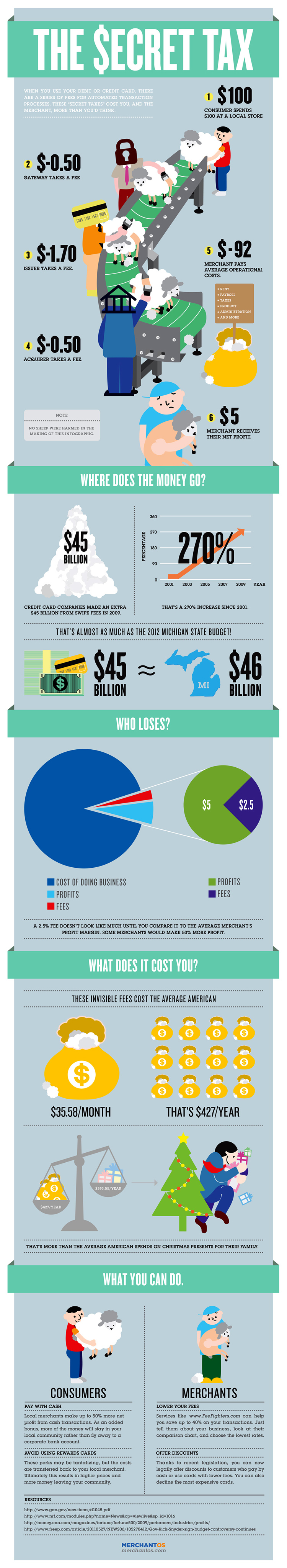

But there's a cost to this shift to a cashless society. Credit card issuers like Visa and MasterCard, collect fees from the merchant every time they swipe. For businesses that have thin margins, these fees can hurt. And the rates are even higher for transactions in which the credit card is not present.

MerchantOS, a web-based point of sale software vendor, has put together some of the hidden fees that merchants face every time a customer uses a credit card. In order to reduce fees, the company advises business owners to offer discounts for customers who pay in cash or use credit card with lower fees. It's an uphill battle though, as the convenience of paying by credit card will always likely outweigh the inconvenience of the invisible fees for consumers.

Check out the infographic from MerchantOS, below.