With iPhone 6 and Apple Pay, the NFC Mobile Payments Era Is Set to Flourish

Apple held a major, time-stopping event today to unveil several much-anticipated new products. That it unveiled a new version of its market-leading iPhone wasn’t a shock. Nor was it a surprise that the company announced its new Apple Watch product line, as the company had been rumored to be working on a watch product for the past several years.

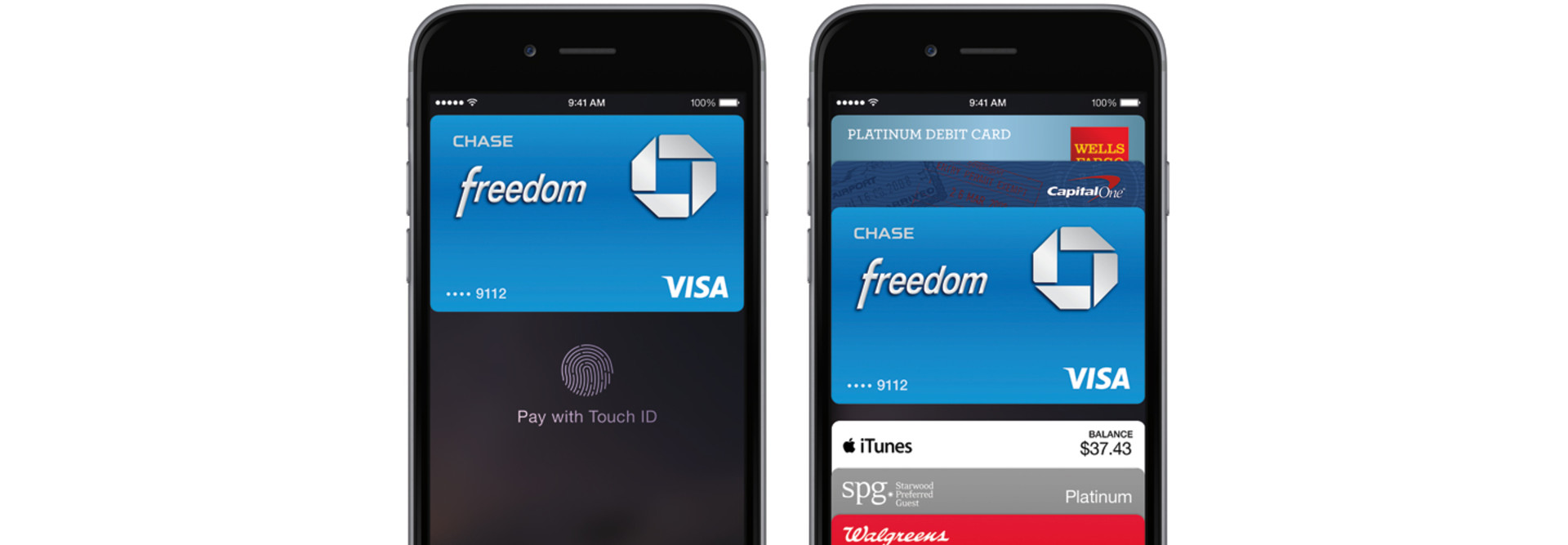

The big surprise at the event was the announcement of Apple Pay and the company’s embrace of near-field communication technology.

After shirking NFC functionality in its phones for years, many assumed Apple was simply uninterested in the space. Other mobile payment vendors, such as Square, have eschewed NFC, so it seemed probable that even if Apple did launch a mobile payment solution at some point that it might not involve NFC.

But Apple Pay proves that the company was merely waiting for the right time to integrate NFC, as an NFC antenna will now be included in the iPhone 6.

“Apple Pay will change how you pay with breakthrough contactless payment technology and unique security features built right into the devices you have with you every day,” the company claims.

Building Up the Partnership to Succeed in Mobile Payments

While the technology involved in Apple Pay is impressive, even more remarkable is the laundry list of big-name retailers that Apple has signed up to accept payments from the service — names like Whole Foods Market, Panera Bread, Walgreens, McDonalds and more.

Establishing an ecosystem of retailers is essential to kick-starting the mobile payments revolution because without their participation, Apple will have amazing technology that consumers can’t use in the real-world.

Apple has also lined up partnerships in the financial services sector, signing agreements with Bank of America, Capital One and other major financial institutions.

A Better Way to Pay

The promise of a mobile payments evolution isn’t just tied to convenience. Yes, not having to carry around tons of plastic to pay for goods and services will mean we can reduce those ugly wallet bulges. But Apple actually sees its Apple Pay system as a more secure way to make payments.

“This whole [payment] process is based on this little piece of plastic, whether its a credit or debit card,” Apple CEO Tim Cook said during the presentation. “We’re totally reliant on the exposed numbers, and the outdated and vulnerable magnetic interface — which by the way is five decades old — and the security codes which all of us know aren’t so secure.”

The company’s Touch ID technology, which it rolled out with the iPhone 5S last year, will also play a role in securing Apple Pay, reports The Verge.

Apple is hoping to counter these concerns with hardware and software, including Touch ID, the Secure Element chip, and a dynamic security code that is generated for each transaction, replacing the static security code on the back of your credit card. If your phone is stolen, you can use Find My iPhone to suspend all payments from the device.

Retailers should consider the announcement of Apple Pay and the iPhone 6’s NFC antenna to be a resurrection of sorts. While many began to wonder if NFC was dead as a solution for mobile payments, with the latest developments from Apple, it’s clear that the technology is alive and kicking.