It's Not Just Retailers — Banks Need to Prepare for Data Breaches Too [#Infographic]

The recent spate of cyberattacks against prominent organizations such as Target, Neiman Marcus and Kickstarter may have drawn plenty of attention, but many of the attacks leveled against banks don’t routinely get such mainstream publicity.

But just because the front pages of the nation's papers aren't plastered with the latest cybersecurity challenges facing the banking industry doesn't mean those challenges aren't plentiful.

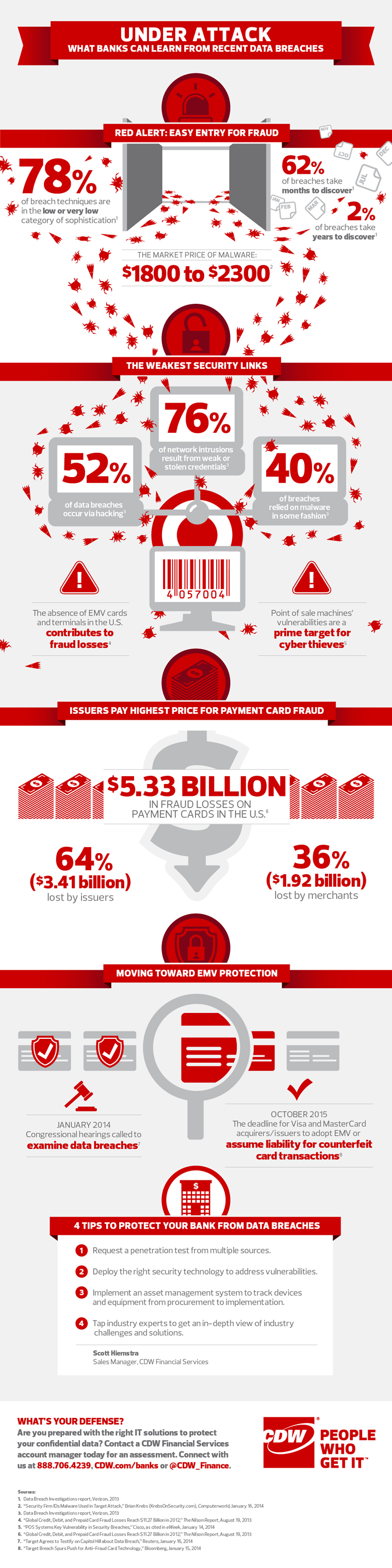

A common theme of cyberattacks isn't their brazenness or complication. Rather, it's their relative unsophistication, and the duration of time they go undiscovered, according to Verizon's 2013 Data Breach Investigation Report.

Of particular note for banks is the vulnerability of two of their most important assets: ATMs and file servers, which Verizon ranked as two of the top three most vulnerable to cyberattacks.

So while cyberattacks are becoming increasingly prevalent, that doesn't mean banks should feel helpless. With proper preparation, and the right cyber security practices, your bank can turn itself into a digital Fort Knox.

After all, according to Verizon's study, more than three-quarters of network intrusions made use of “weak or stolen credentials,” and 29 percent of attacks employed social methods like phone calls or emails to obtain access. So these relatively simple incursions can be prevented [went for simpler, more direct phrasing; you're welcome to revert to your original].

And the industry is aware of the dangers, with 93 percent of banks and other businesses worldwide at least maintaining or increasing their cyber security efforts, according to Ernst & Young's 2013 Global Information Security Survey.

So check out the infographic below for details on how your bank can bolster its protections, courtesy of CDW Financial Services: