Nico Stein had a suspicion that this wasn’t going to be a regular Friday morning.

Stein, the vice president of IT at Signal Financial Federal Credit Union, was driving to his office at the credit union’s headquarters in Kensington, Md. As he looked around him, he saw more people than usual on their cellphones, he recalls, “and there was lots of wild gesturing, like something big might be happening.”

When Stein finally arrived at work, a colleague informed him that close to 90% of the organization’s servers were down. He also learned that Signal Financial wasn’t the only business with an IT outage: A faulty automated software update had led to computer disruptions around the world.

Click the banner below for hybrid infrastructure, data protection and storage solutions.

“That explained what I’d seen on my drive, not that it made me feel any better,” Stein says. The credit union’s members wouldn’t be happy if they couldn’t access their accounts and make transactions. “Like everyone else, we needed a fix, and we needed to do it as quickly as possible.”

Fortunately, Signal Financial had an ace up its sleeve: As part of the financial services sector, it follows stringent regulations governing its approach to ensuring business continuity. For years, it had leaned on Veeam for this purpose, specifically the Veeam Data Platform, which automates data protection with backup and disaster recovery (DR) capabilities. In this case, Signal was dealing with Windows systems that had suddenly become unbootable, so Stein decided to leverage a Veeam tool that allows users to create copies of a computer’s OS.

“With that, boom, we could reboot. And from there, it was basically busy work,” he says. “We had everything up and running again within a couple of hours.”

Dependable Backups Are Required in Financial Services

Talk with any IT leader in the financial services industry and chances are that they’ll say much the same thing. Whether they’re responsible for the systems at a regional credit union or managing the network at an insurance company, the ones who can sleep well at night tend to be those with reliable DR solutions.

“When I can trust that my backups work, that makes my life easier,” Stein says. “It’s one less problem I have to worry about out of the thousand things I worry about every day.”

FIND OUT: What is shadow data and how can organizations avoid it?

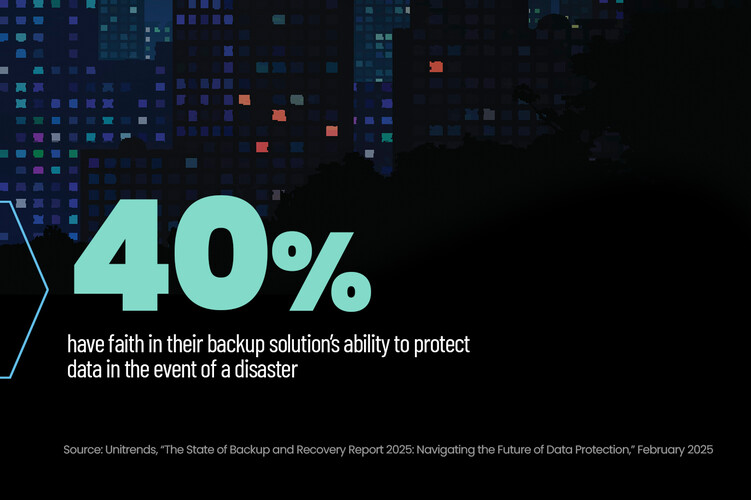

In light of the threats these companies face, from unexpected crashes such as the one at Signal Financial to cyberattacks launched by state-sponsored adversaries, it’s no surprise that many see backups as central to business continuity. Recent research from Unitrends shows that close to 90% of organizations overall have experienced downtime due to on-prem outages in the previous 12 months. And according to a 2024 survey by Commvault, more than 80 percent of businesses have suffered at least one significant security breach — a ransomware attack, for example, or data loss resulting from a software vulnerability.

More worrisome is that these breaches are becoming increasingly common, Commvault reports. About half took place within the past year, and more than 75% occurred in the previous 18 months.

64%

The share of organizations that test their backups at least monthly

Source: Unitrends, “The State of Backup and Recovery Report 2025: Navigating the Future of Data Protection,” February 2025

According to Bob Arnold, president of Disaster Recovery Journal, the impetus for backups for financial services companies goes beyond peace of mind to what’s required of the industry by law. Regulators including the Federal Trade Commission and the Office of the Comptroller of the Currency, for example, expect institutions to back up customer data in compliance with the Gramm-Leach-Bliley Act of 1999. Similarly, the Securities Exchange Act of 1934 mandates that brokerage firms use backup systems that preserve data integrity while allowing for audits, and the Federal Financial Institutions Examination Council requires all financial firms to have business continuity and DR plans.

RELATED: The financial solutions from CDW that can fortify data protections.

“Financial services companies are on the hook for huge penalties if their systems stop working and they can’t serve their customers,” Arnold says. “And it’s been that way for 30 years or more, which is why the industry is so mature in that area.”

Ranging from platforms such as Veeam’s Disaster Recovery as a Service to solutions from companies including HPE Zerto and Druva, backup technologies are used to create copies of data for easy restoration following a catastrophic event. The best rely on techniques such as air gapping to isolate the copies in storage systems that are physically separated from a company’s main IT network. They also ensure the data storage is immutable; information can’t be changed or deleted.

Signal Financial has firewalls and other cybersecurity defenses, Stein says, but he also knows the company can’t win every battle. “Eventually, something’s going to get through. So, what are we going to do then? For us, that’s where our backups come into play. We’re focused on how fast we can recover.”

How Good Backup Solutions Ease Compliance

First Commonwealth Bank has used Veeam to replicate its virtual servers for DR since 2015, says Eric Kubla, the organization’s assistant vice president and IT server manager.

Like many financial institutions, First Commonwealth — a community bank with more than 125 branches in 30 counties in Pennsylvania and Ohio — maintains nearly all customer experience data in a data warehouse that interfaces with the bank’s contact center and its customer relationship management systems. The organization’s goal is to efficiently replicate its data warehouse and simplify and speed up DR testing during compliance audits.

In replication, Kubla explains, each virtual machine’s data is copied and moved to a different site, such as another data center or a public or private cloud. If a VM goes down, the technology allows IT to fail over immediately to the backup system.

Three years ago, that functionality proved critical when a power outage caused the bank to lose a data center at one of its branches, he says: “We just went into Veeam, and within a few minutes we had our systems back on in another location.”

When it comes to the bank’s compliance requirements, Kubla notes that First Commonwealth is subject to all kinds of regulations. “It seems like we’re dealing with compliance checks and audits 52 weeks out of the year.” The good news is that the bank’s DR solution “checks all the boxes” required by federal laws. “We can do our DR tests to make sure everything works, and we can easily prove that we’re backing up our data.”

Kubla adds that, like anyone else in financial services, he’d prefer to not have to think about the lurking threats to his company’s data. At the same time, he’s a realist. “You hope you never have to deal with them,” he says. “But they’re out there, so you prepare.”