Data Analytics Can Help Financial Firms Master Risk Management [#Infographic]

Financial and investment firms face numerous risk-related challenges, including regulatory compliance, technology issues and operational hazards. How can they best use technology to manage all of these risks?

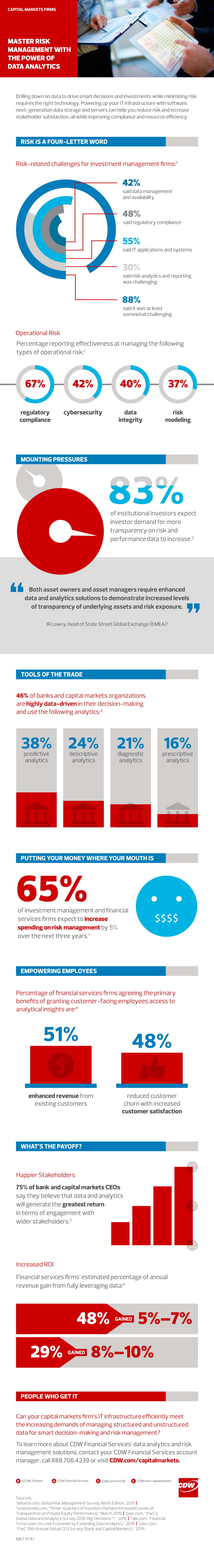

According to a report from consultancy Deloitte, which surveyed 71 financial services institutions around the world that operate across a range of financial sectors, 67 percent felt their organization was extremely or very effective in managing regulatory compliance as an operational risk. But in other areas, the numbers were significantly lower: Effectiveness ratings were only 42 percent for cybersecurity and 40 percent for data integrity. Not surprisingly, Deloitte found that 65 percent of investment management and financial services firms expect to increase spending on risk management by 5 percent over the next three years.

Financial services firms expect they will be asked to increase transparency on risk and performance data. What can such firms do to make sure they address risk management properly?

Analytics technology is a key tool they can employ. According to a report from consultants at PwC, 46 percent of banks and capital market organizations are highly data-driven in their decision-making. Fully 38 percent use predictive analytics, 24 percent use descriptive analytics, 21 percent employ diagnostic analytics tools, and 16 percent use prescriptive analytics.

Check out the infographic below to see how financial services firms are using technology to manage risks. And download this CDW white paper to learn more about data analytics and how financial services firms can tap the power of business intelligence tools to boost their bottom line.