The Branch of the Future Will Rely on IT [#Infographic]

Just like in the retail space, the trend away from a physical space to a digital one is impacting the way that banks and financial services companies do business. While the branch was once the cornerstone and the storefront for a banking customer, it has become far less essential thanks to mobile and online banking.

Does that mean that physical branches will disappear? No, but it does mean that like brick-and-mortar stores (or libraries), branches must be reimagined to take advantage of technology and integrate it into the in-branch experience. There's still value in engaging with customers face to face, but banks must identify what those values are as transactions largely shift to a digital, self-service model.

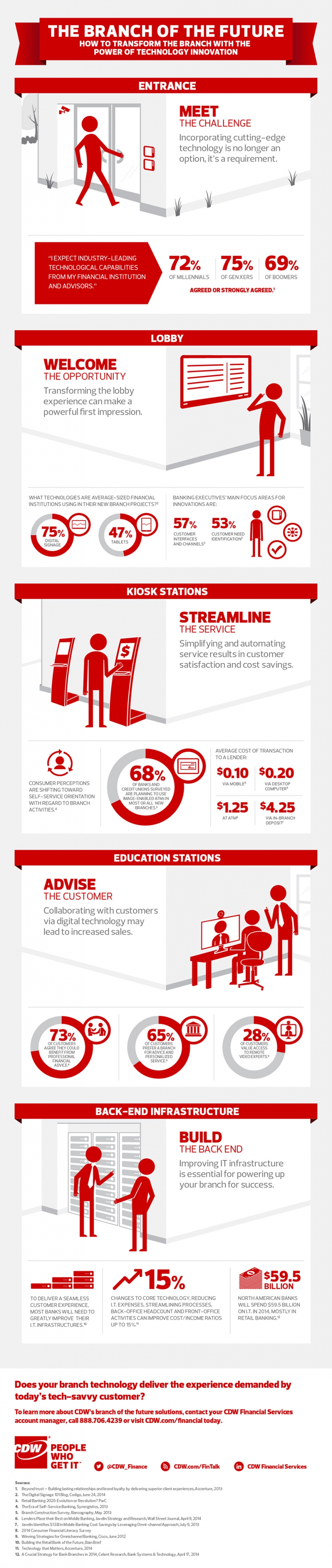

CDW's FinTalk Blog has assembled some key statistics and facts about the future of the branch into an infographic. Some key findings include:

- 72 percent of millennials expect industry-leading technology capabilities from their financial institutions

- The average cost of a transaction is $.10 on mobile compared to $4.25 via in-branch deposit

- 65 percent of customers prefer a branch for advice or personalized service

- $59.5 billion is what North American banks are expected to spend on IT in 2014

You can view the full infographic from CDW below.